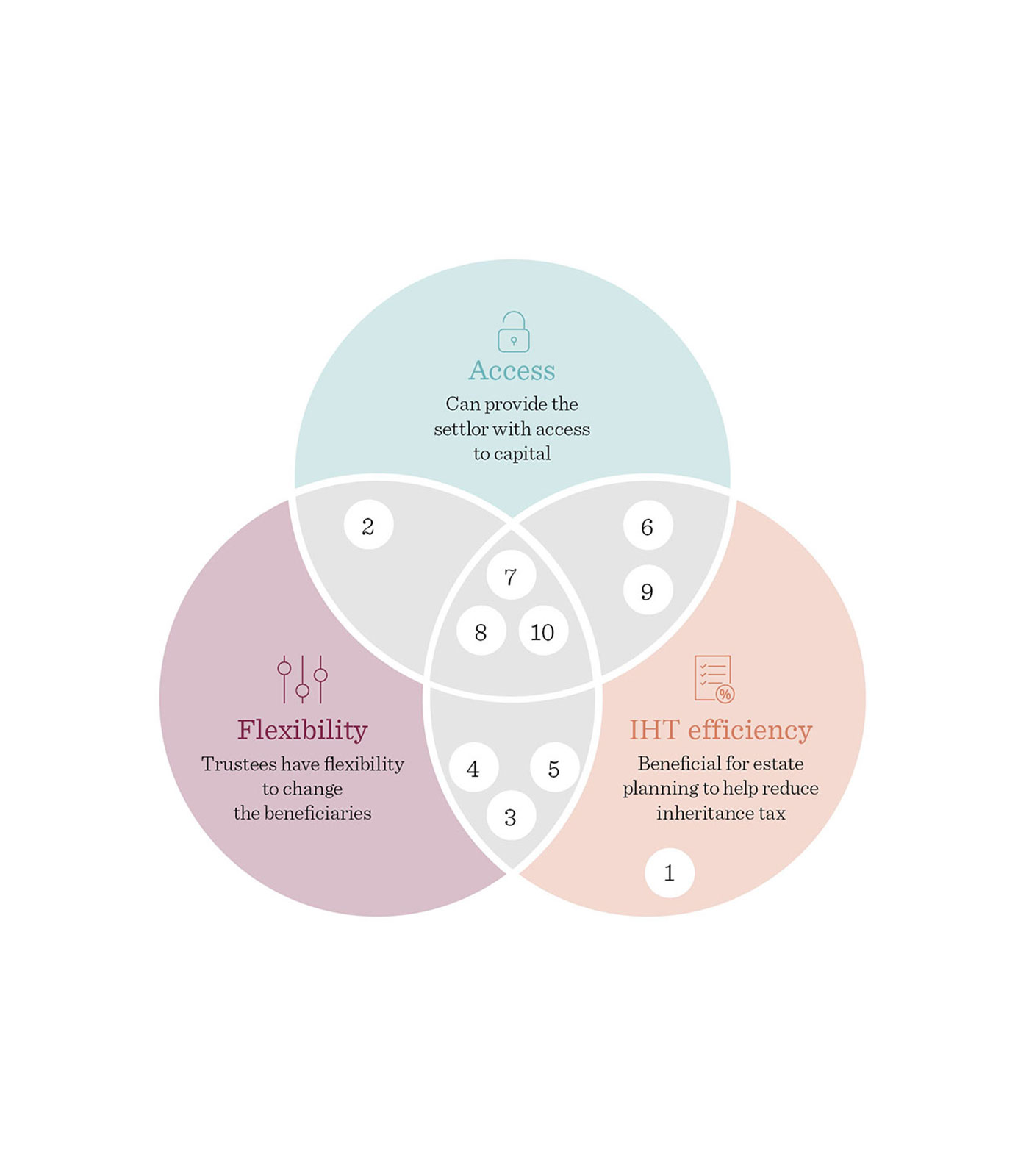

Our most popular trust, The Lifestyle Trust, provides a combination of flexibility, IHT efficiency, and access for your clients. Use this diagram to help guide you through our full range of trusts, with key facts about each trust.

Our trusts

1. Absolute trust

A simple IHT solution where the client does not require access to the capital, knows who they want to leave their wealth to, and requires no future flexibility.

Absolute trust2. Discretionary trust - settlor included (Probate trust)

Provides clients with control and flexibility over how wealth is distributed. As the client is also a beneficiary, it is not IHT efficient.

Discretionary trust - settlor included3. Discretionary trust - settlor excluded

An IHT solution for clients who do not require access to capital and want control and flexibility over distribution of wealth.

Discretionary trust - settlor excluded4. Best start in life trust

A discretionary trust that can provide tax-efficient payments and gives clients an IHT-efficient way of passing on wealth during their lifetime or on death.

Best start in life trust5. Excess income trust

A discretionary trust that uses a client’s excess income to build a nest egg for beneficiaries in the future, free of IHT.

Excess income trust6. Discounted gift trust - bare

The client gifts money to a trust and receives regular fixed capital payments for the whole of their life or until the fund runs out – no discretion to change beneficiaries.

Discounted gift trust - bare7. Discounted gift trust - discretionary

The client gifts money to a trust and receives regular fixed capital payments for the whole of their life or until the fund runs out – discretion to change beneficiaries.

Discounted gift trust - discretionary8. Lifestyle trust

A flexible solution where the client gifts money to a trust and has the option of taking capital payments plus any growth at fixed points in the future.

Lifestyle trust9. Loan trust - bare

Provides clients with unrestricted access to the original capital invested, with future investment growth being outside of their estate for IHT – no discretion to change beneficiaries.

Loan trust - bare10. Loan trust - discretionary

Provides clients with unrestricted access to the original capital invested, with future investment growth being outside of their estate for IHT – discretion to change beneficiaries.

Loan trust - discretionaryGet in touch with your Quilter consultant

Our consultants are here to help you find the best solutions for your clients. Get in touch if you need additional support.