Understanding the differences

Once the 'what' and the 'how' are answered, the next question is how different asset classes are combined i.e. what is the asset allocation? Again, there are a variety of approaches. Some multi-asset passives follow a fixed allocation – for example 60% equity and 40% bond. This is simple and easy to explain. However, in years like 2022, holding a high proportion of fixed income was damaging to cautious investors, and this fixed approach slavishly follows its asset allocation regardless of whether it is appropriate or not. Other processes consider current market values and economic indicators and aim to create a forward-looking asset allocation. This is not without complexity, but it can manage the pitfalls of overpriced assets better than a fixed asset allocation.

The last area to consider is whether there should be a rebalancing process, and if so, how often. Answers to this vary from 'never' to 'daily'. The more infrequently portfolios are rebalanced, the greater the chances of drift in terms of risk – which may be inappropriate for your advice process. Conversely, a higher frequency can lead to increased trading costs. However, even then, the word ‘rebalance’ can mean different things. In some cases, it will mean resetting back to the last rebalance. In others, it will mean considering new inputs from time to time and updating to follow these. Again, this discipline will have a significant effect on investment returns over time, so it is worth fully exploring.

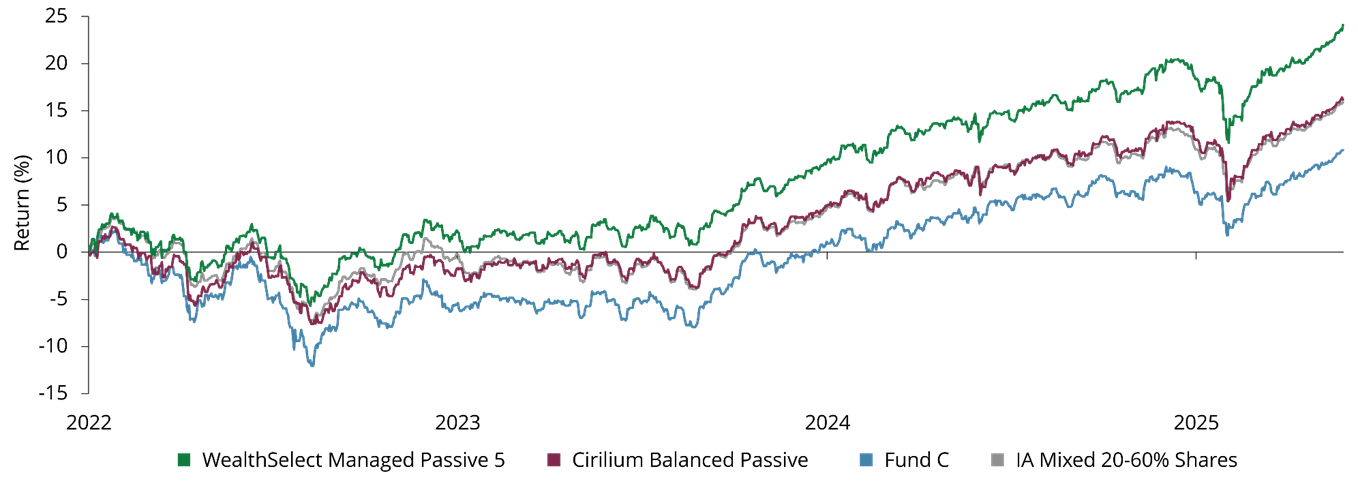

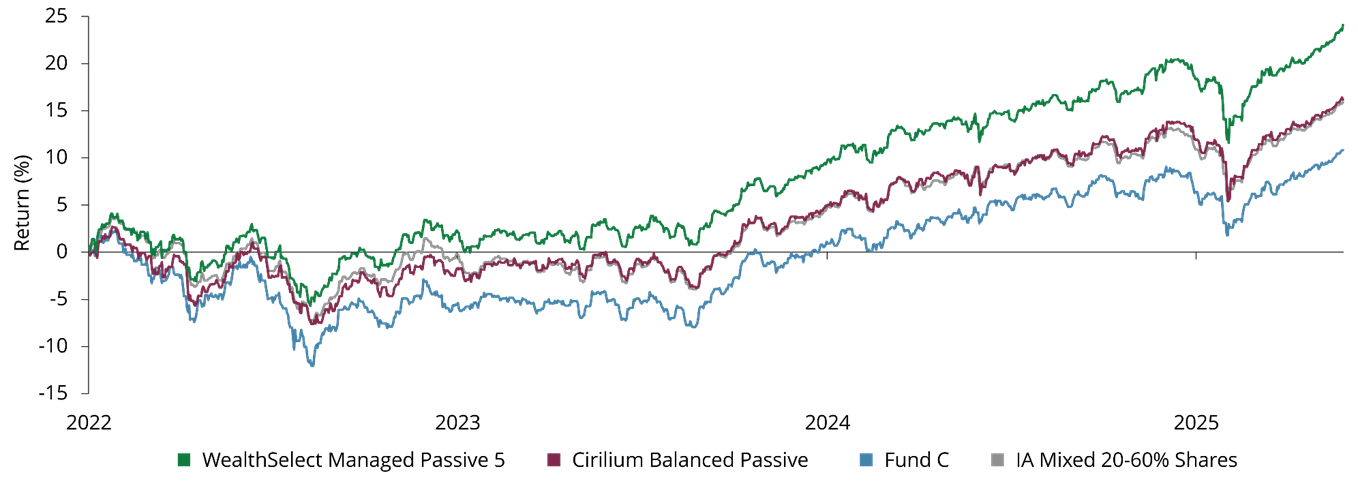

The chart below shows a multi-asset passive fund (Fund D) that sits in the IA Mixed 20-60% Shares sector. The fund follows a fixed asset allocation, with 40% in equities and 60% in fixed income and rebalances to this on a daily basis. The chart also shows the WealthSelect Managed Passive 5 Portfolio and the Cirilium Passive Balanced Fund, which use a forward-looking asset allocation process that combines the potential returns of asset classes with their volatility and correlation to create an appropriate asset allocation. As you can see the outcomes of the different approaches can be quite different.

Return since launch of WealthSelect Managed Passive 5 vs peers

Past performance is not a guide to future performance and may not be repeated.

Source: Quilter and FactSet as at 31 July 2025. Total return, percentage growth (rebased to 100) over period 8 March 2022 to 31 July 2025. All performance figures are net of underlying fund charges, but gross of the Managed Portfolio Service charge. Deduction of this charge will impact on the performance shown. The WealthSelect Managed Passive 5 Portfolio launched on 8 March 2022.

Making the right choice

So, a multi-asset passive fund may passively follow a defined set of rules, but the decisions taken to create the rules are active – as is the decision of advisers as to which multi-asset passive fund to use. If you are considering using a multi-asset passive fund it is worth understanding exactly how it operates in each of these areas, as it will have a highly significant effect on the investment outcomes for your clients. Not all passives are created equal.