Mohammed Usman Ali

Financial Planning Consultant ACSI in Bradford

A little bit about Mohammed

As a dedicated financial adviser and jiu-jitsu enthusiast, I bring a strategic and disciplined approach to helping my clients secure their financial futures. Just as in jiu-jitsu, where each move requires careful planning and adaptability, I apply the same principles to financial planning, focusing on creating flexible strategies that can adapt to life’s changes and challenges.

Start the conversation

An adviser’s insight

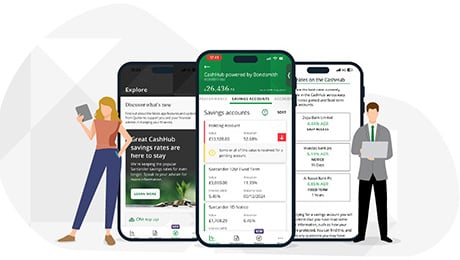

Aim to maximise your cash savings

It might shock you to know that 28% of people hold their cash in interest-free savings accounts(1), receiving no return on their hard-earned money. Because under current rules a basic rate taxpayer can earn up to £1,000 in interest from their savings without paying tax, these people could be missing out on a significant financial boost that they could be enjoying.

This is even more relevant when you consider that the average person typically holds up to 25% of their available money on cash deposit(2). So, by reviewing your cash and tackling any ‘lazy money’, you’ll be making a great start at getting your finances in shape and achieving longer-term financial security.

If your money isn’t working as hard as it could, I can help. By making it easy to access potentially better interest rates, I can help you to aim to maximise your cash savings – giving you more money to spend on the things you enjoy or helping you grow your money towards a longer-term goal.

1 Building Societies Association Sept 2024

2 The Lang Cat: Cash as an asset class survey June 2024

Cash on deposit advice is not regulated by the Financial Conduct Authority.

Services

Business Services & Protection

Commercial mortgages/remortgages, workplace pension and employee benefits. Commercial mortgages are by referral only.

General Insurance

Home contents insurance, buildings insurance.

Holistic planning

Establishing and reviewing trusts, complete personal risk management planning, short- and long-term savings and investments.

Income Protection

Permanent health insurance to provide a regular income should you be unable to work due to illness or injury.

Investments

Wealth management advice to make your money work as hard as it can for you, including making the most of any tax breaks available.

Pensions

Expert advice to help provide comfort in your retirement.

Protection

Whole of life and term assurance protection, private medical arrangements, critical illness insurance.

Qualifications

Diploma in Investment Advice

- The Diploma in Investment Advice provides a sound grounding in UK financial services and consumer relationships, including exchange traded futures and options and financial protection.

More about me

With a passion for guiding individuals and families in building robust financial plans, I specialise in helping clients invest their savings, prepare for retirement, and plan for long-term financial success.

My approach combines in-depth financial knowledge with a genuine commitment to understanding your unique goals and values, so we can build a personalised plan that reflects your vision for the future. Whether you’re looking to maximize your investments, create a retirement roadmap, or ensure your family’s financial security, I’m here to provide clarity and confidence every step of the way.

Key Areas of Expertise:

• Retirement Planning

• Investment Strategy

• Wealth Accumulation & Preservation

• Tax-Efficient Savings

Let’s work together to develop a financial plan that’s as resilient and focused as you are. Reach out to schedule a consultation, and let’s take the first step toward achieving your financial goals.

The Financial Conduct Authority does not regulate some employee benefits, tax planning, inheritance tax planning, estate planning, succession planning, trusts or some buy-to-let mortgages.

The guidance and/or information contained within this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.

Registered Office: Quilter Financial Advisers, Senator House, 85 Queen Victoria Street, London, EC4V 4AB. Tel: 0207 562 5856. Registered in England and Wales. Registered number: 05693185. Lighthouse Financial Advice Limited, Senator House, 85 Queen Victoria Street, London, EC4V 4AB. Tel: 0207 562 5856. Registered in England and Wales. Registered number: 04795080.