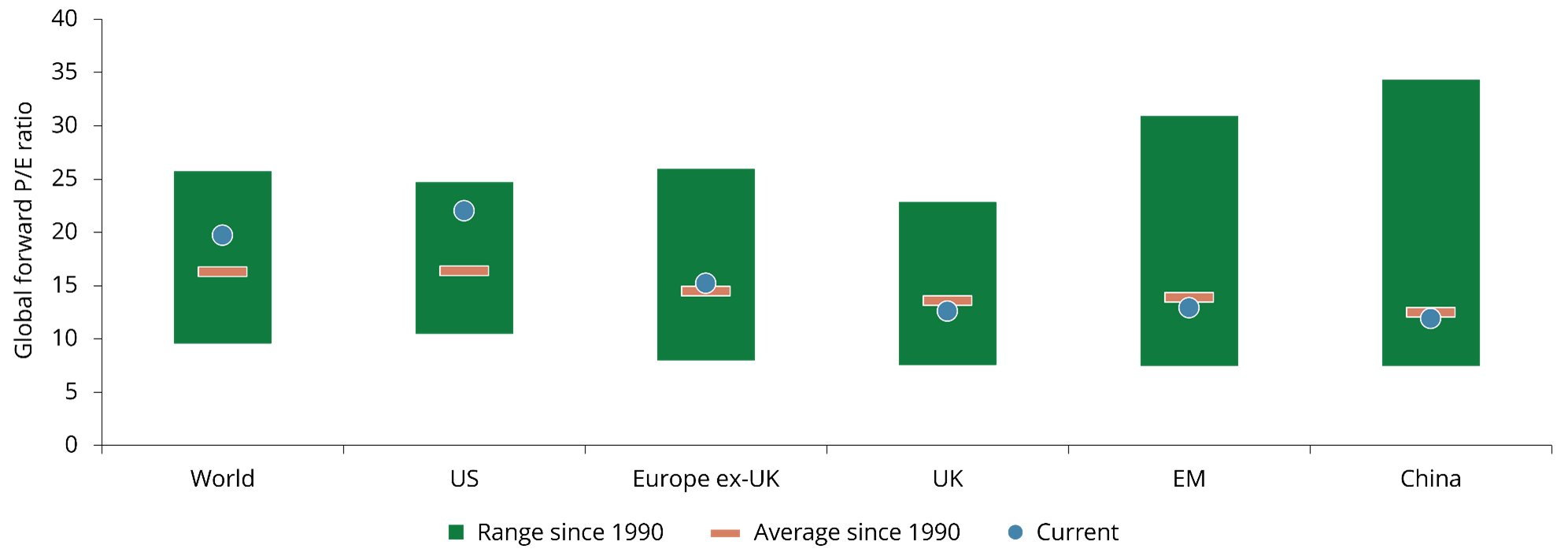

Despite ongoing political uncertainty and a sharp decline in the value of the dollar, US equities have continued their upward trajectory, hitting new all-time highs. However, with stock valuations hovering near historic highs, some multi-asset investment strategies that adopt a market-cap approach to regional equity markets may be exposed to elevated risks.

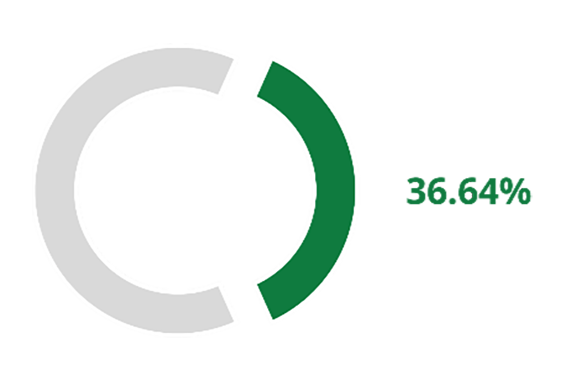

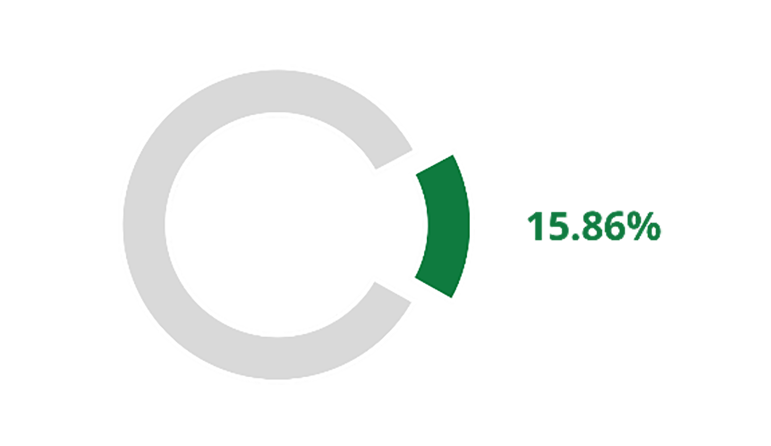

The strong performance of US equities in recent years has been a major driver of global equity returns. On a market-cap weighted basis, US equities now represent 66% of the MSCI ACWI. Within the MSCI USA Index, the 'Magnificent Seven' tech giants account for more than one-third of the index – a testament to their extraordinary growth. It is also interesting to observe that in 2015, the top ten holdings in the index were diversified across various sectors whereas it is now much more concentrated on tech stocks riding the artificial intelligence narrative. This surge has been nothing short of remarkable, reshaping the global equity landscape and significantly amplifying returns for investors following a market-cap weighted investment approach.