In order to aid your understanding, the underlined terms are hyperlinked to definitions in our online investment glossary.

Our market summary

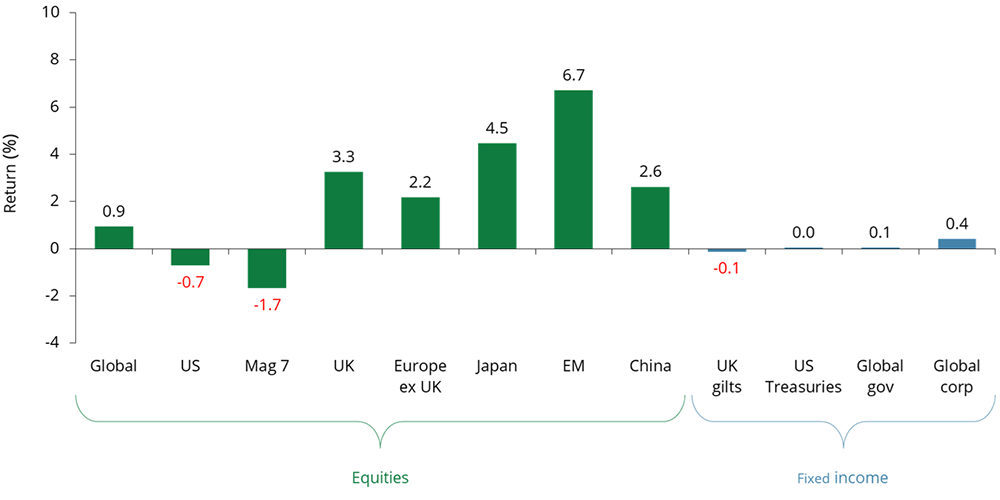

January was a positive but volatile month for global markets. Equity markets rose overall, up 0.9%, supported by better-than-expected economic data, resilient corporate earnings, and easing inflation pressures. Investor confidence improved as growth expectations strengthened, encouraging a shift towards risk assets. However, markets were unsettled at times by heightened geopolitical tensions, renewed tariff threats, and uncertainty around future central bank leadership, particularly in the US. Performance broadened beyond the mega-cap US tech stocks, with smaller companies, Japan, and emerging markets leading gains. Fixed income markets were more mixed, as stronger economic data pushed bond yields higher in some regions. Commodities, especially energy and precious metals, also performed strongly, reflecting geopolitical risks and firmer demand expectations.

US

US

In January, US equities delivered modest gains in US dollar terms, but due to the weakness of the US dollar, this resulted in a 0.7% loss for sterling-based investors. Strong corporate earnings and upbeat economic data supported markets, although leadership narrowed compared with previous months. Smaller and mid-sized companies outperformed large caps, reflecting improved confidence in domestic growth. Meanwhile, financials and industrials performed well, while tech stocks lagged late in the month due to valuation concerns. Policy uncertainty weighed on sentiment throughout January, with renewed tariff threats and concerns around the independence of the US Federal Reserve (the Fed) following the decision by the US Department of Justice to begin a criminal investigation into current Fed Chair, Jerome Powell. However, the nomination of Kevin Warsh to be the next Fed chair was well received at the end of the month.

The performance figures shown refer to past performance. Past performance is not a reliable indicator of future performance.

Europe

Europe

European equities rose by 2.2%, benefiting from an improving global risk appetite and a broadening of market leadership away from US mega cap stocks. Economic data surprised positively, with eurozone growth exceeding expectations and unemployment falling to record lows. Falling inflation supported confidence in a gradual easing of monetary policy. Defence, energy, and information technology stocks performed well, helped by increased government spending commitments and solid earnings. However, consumer-focused sectors and property lagged. Geopolitical tensions, particularly surrounding US policy, caused temporary volatility but eased later in the month.

The performance figures shown refer to past performance. Past performance is not a reliable indicator of future performance.

UK

UK

UK equities posted solid gains of 3.3% in January, supported by improving economic momentum and strong performance from value-oriented sectors. Rising commodity prices, particularly metals and energy, boosted the large mining and oil stocks. However, smaller companies outperformed larger peers, reflecting growing confidence in domestic growth prospects. Economic data was encouraging, with GDP growth picking up and business surveys signalling economic expansion. However, inflation remained elevated, keeping expectations for interest rate cuts cautious. Consumer discretionary and technology stocks underperformed, while materials, utilities, and energy led gains.

The performance figures shown refer to past performance. Past performance is not a reliable indicator of future performance.

Japan

Japan

Japanese equities were among the strongest performers in January ending the month up by 4.5%. Markets were supported by resilient economic data, optimism around pro-growth fiscal policies, and ongoing corporate governance reforms. Technology-related stocks benefited from continued demand linked to AI, while financials gained as bond yields rose. Political developments, including the prospect of a snap election, added volatility but also reinforced expectations of continued structural reform.

The performance figures shown refer to past performance. Past performance is not a reliable indicator of future performance.

Emerging markets

Emerging markets

Emerging market equities, up 6.7%, outperformed developed markets in January helped by a weaker US dollar, strong commodity prices, and improving earnings expectations. Technology and materials stocks led gains, reflecting robust AI-related demand and rising metals prices. Latin America performed particularly well, supported by easing inflation and expectations of future interest rate cuts. Parts of Asia also saw strong returns, especially in markets linked to semiconductor production. However, performance was uneven. India lagged due to valuation concerns, foreign investor outflows, and higher oil prices, while China underperformed amid weaker domestic economic data and ongoing structural challenges.

The performance figures shown refer to past performance. Past performance is not a reliable indicator of future performance.

Fixed income

Fixed income

Fixed income markets delivered mixed returns in January. Stronger economic data and the improved risk appetite pushed bond yields higher in the US and Japan, weighing on government bond prices, which were broadly flat over the month. Short-dated US Treasury yields rose as expectations for near term rate cuts were pushed back. Credit markets were more resilient, with global corporate bonds up by 0.4%, as economic data remained supportive and default risks stayed contained.

The performance figures shown refer to past performance. Past performance is not a reliable indicator of future performance.

Source: Quilter as at 31 January 2026. Total return, percentage growth over period 31 December 2025 to 31 January 2026. Equities are represented by the appropriate MSCI index, the Magnificent Seven is represented by the Roundhill Magnificent Seven ETF, UK gilts is represented by the ICE BofA UK Gilt Index, US Treasuries is represented by the ICE BofA US Treasury (GBP Hedged) Index, global government bonds is represented by the Bloomberg Global Aggregate Government - Treasuries (GBP Hedged) Index, and global corporate bonds is represented by the Bloomberg Global Aggregate - Corporate (GBP Hedged) Index.

Important Information

The value of investments can fall as well as rise. You might get back less than you invested.

The performance figures shown refer to past performance. Past performance is not a reliable indicator of future performance.

This communication is issued by Quilter, a trading name of Quilter Investment Platform Limited.

Approver: Quilter February 2026

QIP 23842/29/15361