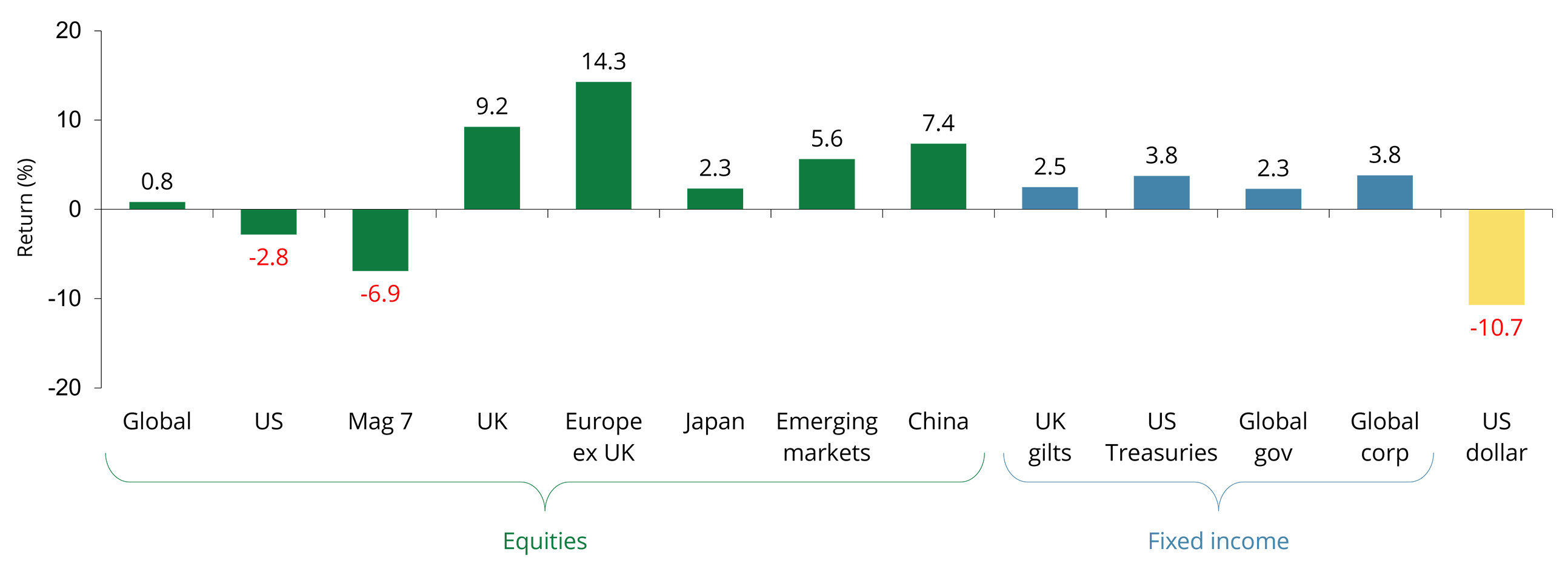

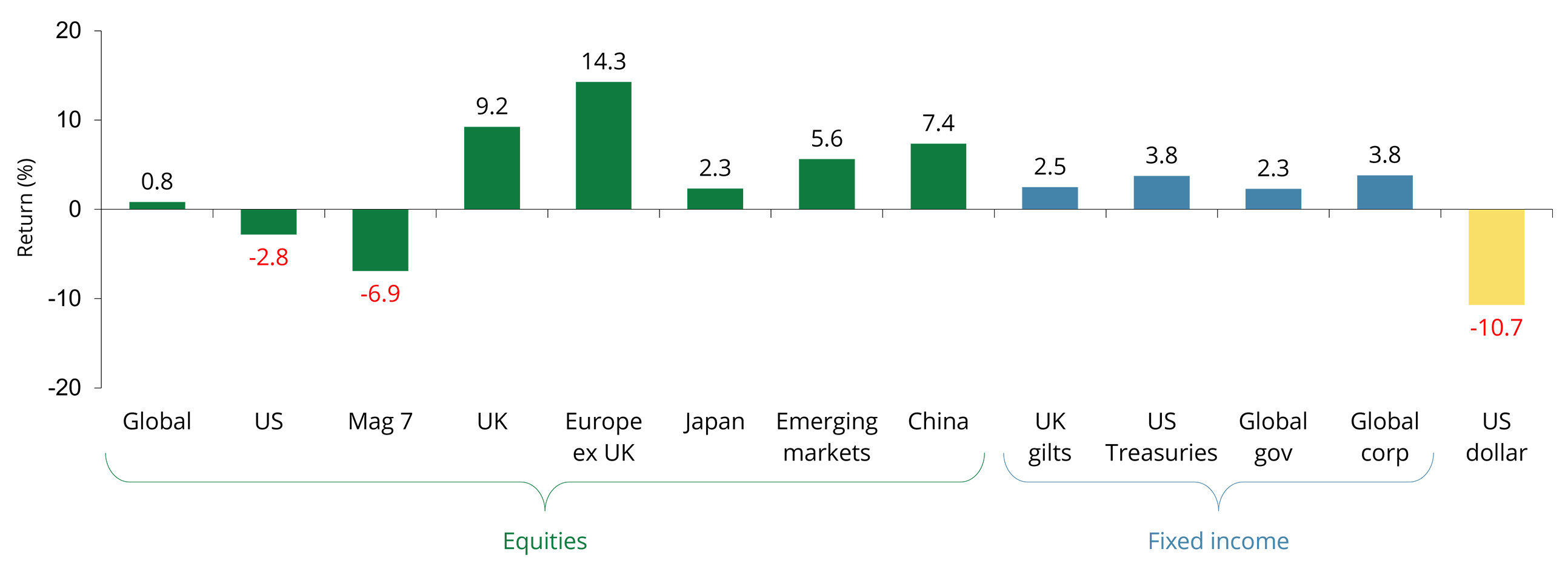

Global equities showed a modest gain of 0.8% in the first half of the year, limited by its heavy weighting to the US, which fell by 2.8%. US equity returns were dragged down by a weak dollar that fell more than 10% against a basket of currencies.

In contrast, regional equity markets performed well. Europe surged 14.3%, the UK climbed 9.2%, and emerging markets rose by 5.6%. Global corporate bonds also rose around 3.8% providing stability during uncertain times. However, it’s important to note that currency differences were the main reason for the varying performances of regional equity markets. When looking at returns in local currency terms, returns were far more aligned.

Market returns so far in 2025

Past performance is not a guide to future performance and may not be repeated. Total return, percentage growth, rounded to one decimal place over period 31 December 2024 to 30 June 2025.

Navigating market uncertainty: defensive shifts, rebounds, and diversification

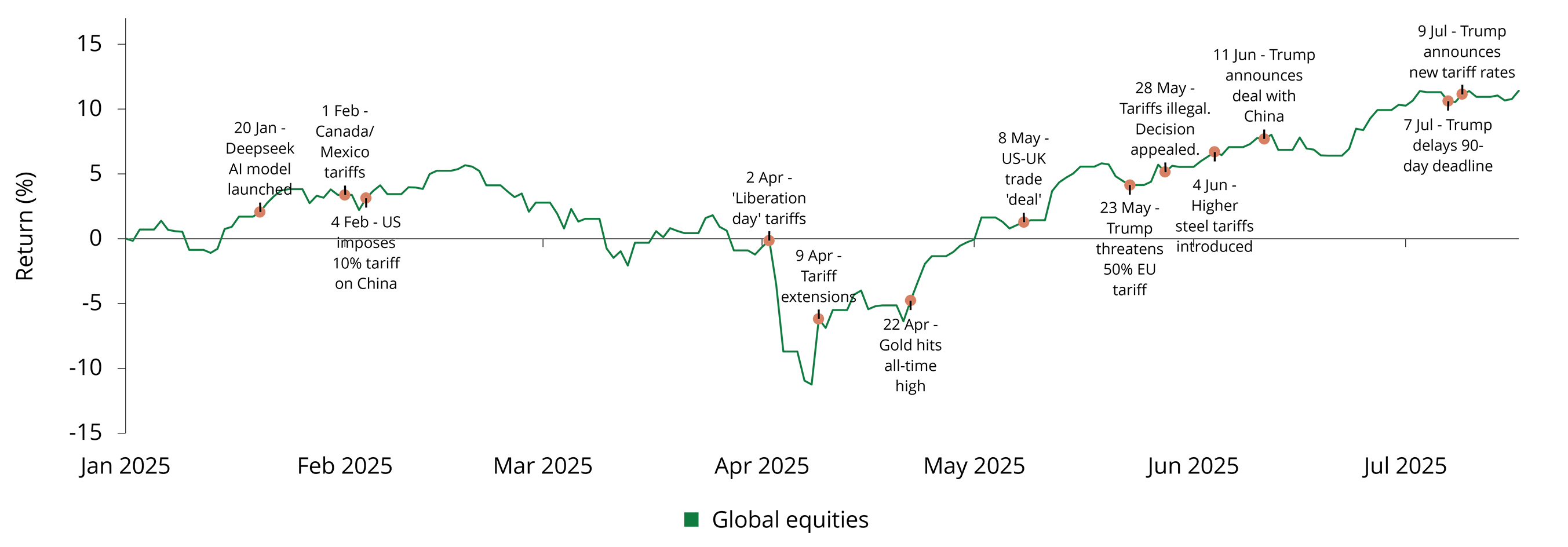

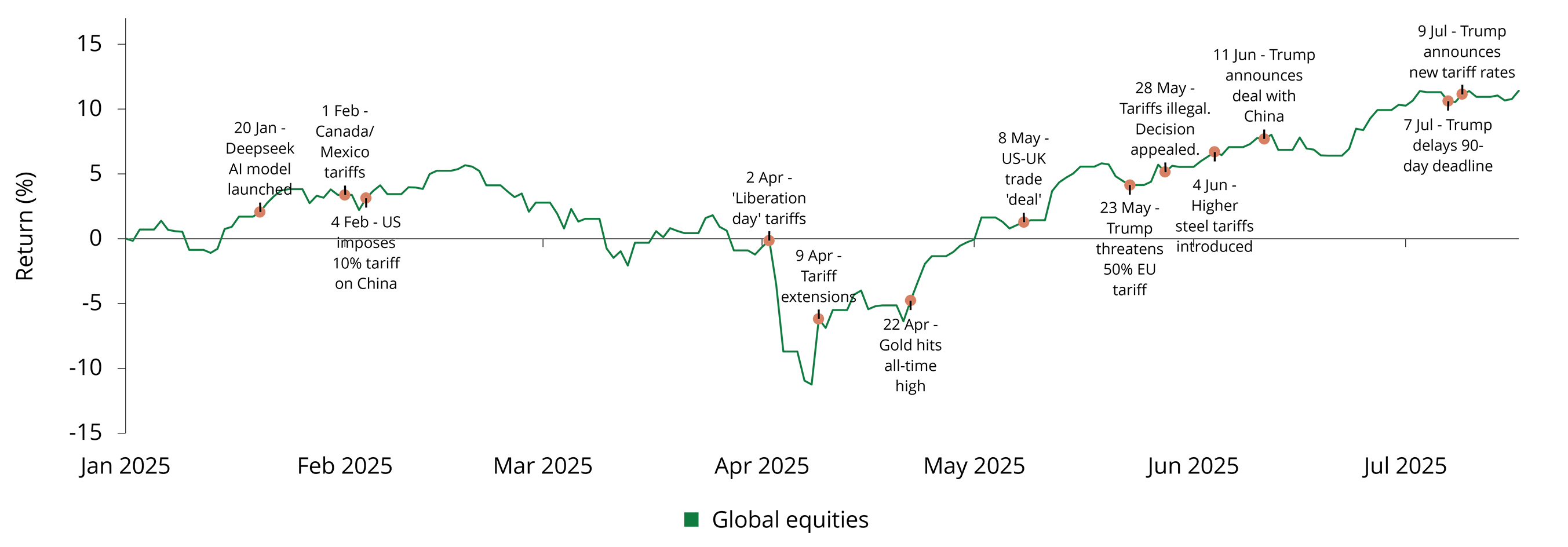

Tariff uncertainty ahead of ′Liberation Day′ prompted investors to favour defensive assets and value strategies. However, since then, US equities have rebounded strongly, recovering from earlier losses, whilst in Europe there has been a continued appetite for value holdings, even as Europe’s fiscal expansion plans (including Germany’s announcement of a €1tn spending initiative) injected early optimism. Gold prices soared due to renewed investor appetite and central bank buying. Amid this turbulent backdrop, broad diversification across assets, geographies, and styles has proved essential in protecting investments and navigating economic uncertainty.

Looking ahead to the second half of the year, uncertainty is expected to continue. The deadline for tariff negotiations has passed and there are threats of reintroducing punitive tariffs. This ongoing uncertainty makes forward business planning very challenging.

Tariffs and their economic ripples

Tariffs will likely lead to a mix of reduced profit margins and higher prices, with international suppliers will also facing pressure to share some of the burden. While the inflationary effects of tariffs are yet to be felt in the US they are expected to appear in the second half of the year as tariffed inventories replace non-tariffed ones. As a result, expectations of GDP growth have weakened more in the US than other developed markets. However, it is important to note that the US still anticipates higher growth.

US equity valuations appear high after a recent rally to dollar-denominated highs. If growth slows and inflation rises, some of these gains may reverse in the second half of the year. However, the global economy has shown more resilience than many expected in 2025, supported by strong household and corporate balance sheets.

Global equity returns so far in 2025

Past performance is not a guide to future performance and may not be repeated. Total return, percentage growth, rounded to one decimal place over period 31 December 2024 to 30 June 2025. Global equities is represented by the MSCI AC World Index.

Europe’s economy shows signs of improvement

European investors have seen positive signs of an improving economy. Real wages are rising, interest rates have fallen significantly, and consumers have accumulated substantial savings in recent years. This pent-up demand could be released boosting the economy.

German fiscal expansion could also lift GDP growth by 2% next year, according to some forecasts. However, this cautious optimism is tempered with the fact that no trade framework has been established between the EU and the US. Additionally, growth forecasts for the Euro area have been downgraded rather than upgraded during the first half of the year as a slower global economy takes its toll.

Elsewhere, despite emerging markets facing similar trade challenges as Europe and equity market performance lagging, valuations are more attractive, and a weaker dollar provides an additional tailwind for the region.

UK chancellor faces difficult trade-offs

In the UK, the main challenge in the second half of the year is the Autumn Budget. The Chancellor is expected to face tough decisions between tax hikes and spending cuts, which could dampen consumer and business confidence. With core inflation remaining stubbornly high, only limited rate cuts are anticipated in the second half of the year. However, valuations remain relatively cheap compared to the wider market and recent trade deals have been broadly supportive.

Fixed income offers good protection

Fixed income continues to offer investors solid protection should recessionary risks rise again. Government bond yields, which ultimately drive interest payments and mortgage rates, are clearly the tramlines tempering the worst excesses of political behaviour. Having been range-bound in recent years for western governments, bond yields are currently at the upper end of this range, offering attractive levels of income. This is largely due to the growing burden of US government debt, the relentless pressure on UK public finances, and global inflationary risks. Given these factors, a diversified and flexible approach to fixed income should be favoured, whilst incorporating assets such as hedge funds, gold, and cash can provide additional stability.

Building resilience through diversification

In summary, the half of 2025 was characterised by tariff-induced volatility and geopolitical shocks, leading to the emergence of different market leadership. Looking ahead ongoing tariff uncertainty, margin pressures and higher prices pose risks. As we await more clarity on these issues, we continue to seek resilience through diversification, whilst taking comfort in the signs that businesses and consumers are overall well positioned to weather the year ahead.

All returns in pounds sterling unless otherwise stated. Source for all data: Quilter and Factset as at 30 June 2025. Total return, percentage growth, rounded to one decimal place over period 31 December 2024 to 30 June 2025. Equities are represented by the appropriate MSCI indices. UK gilts is represented by the ICE BofA UK Gilt Index, US Treasuries by the ICE BofA US Treasury (GBP Hedged) Index, global government bonds by the Bloomberg Global Aggregate Government - Treasuries (GBP Hedged) Index, global corporate bonds by the Bloomberg Global Aggregate - Corporate (GBP Hedged) Index, and US dollar by the US Dollar Index in US dollars

Past performance is not a guide to future performance and may not be repeated. Investment involves risk. The value of investments may go down as well as up and investors may not get back the amount originally invested.

Published: July 2025