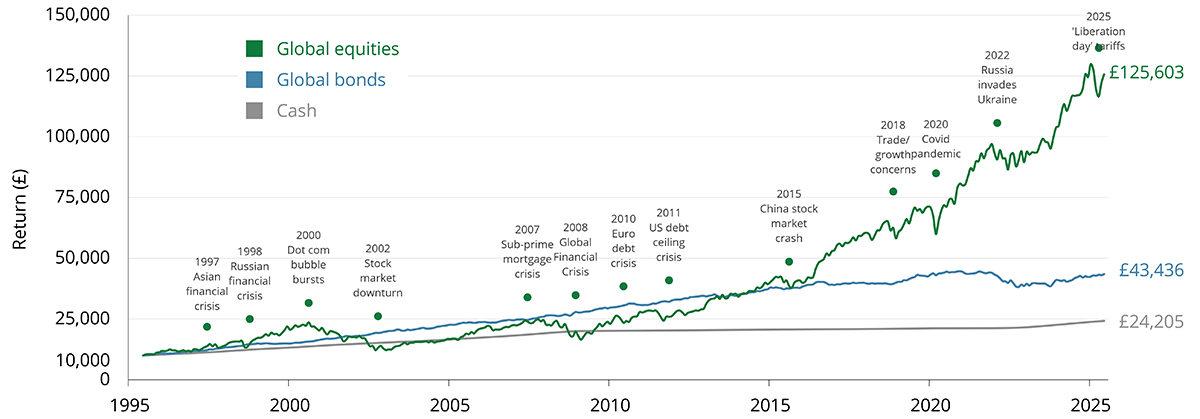

If you are investing for a longer period of time – five years or more – waiting to invest and trying to time the market is likely to result in a poorer outcome.

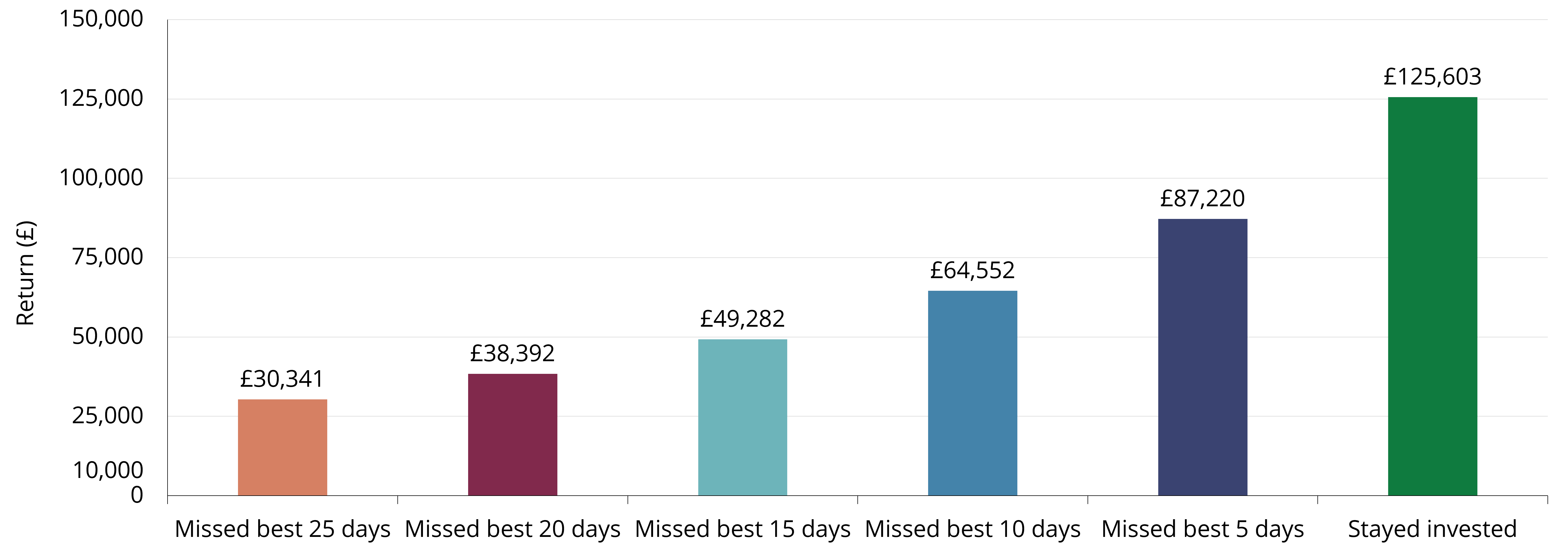

Looking at historical data, we know that the best days in the stock market often come quickly after the worst. An ideal scenario would be to miss the worst days and catch the best days, but that is virtually impossible as no one knows with certainty how markets will change. Getting it wrong and being out of the market for just a few of the best days, can have a devastating effect on your returns.

As the chart below shows, staying invested is by far the best course of action. To give this more context, there have been 7,639 working days over the past 30 years. Missing just 25 of those days, 0.33% of the total, could have resulted in a difference of nearly £100,000.

Past performance is not a guide to future performance and may not be repeated. Source: Quilter and Morningstar as at 30 June 2025. Total return in pounds sterling over period 1 July 1995 to 30 June 2025. Based on an initial investment of £10,000 into the MSCI All Country World Index. The information provided is for illustrative purposes only and doesn’t represent the past performance of any particular investment. It is not possible to invest directly into an index.