Our market summary

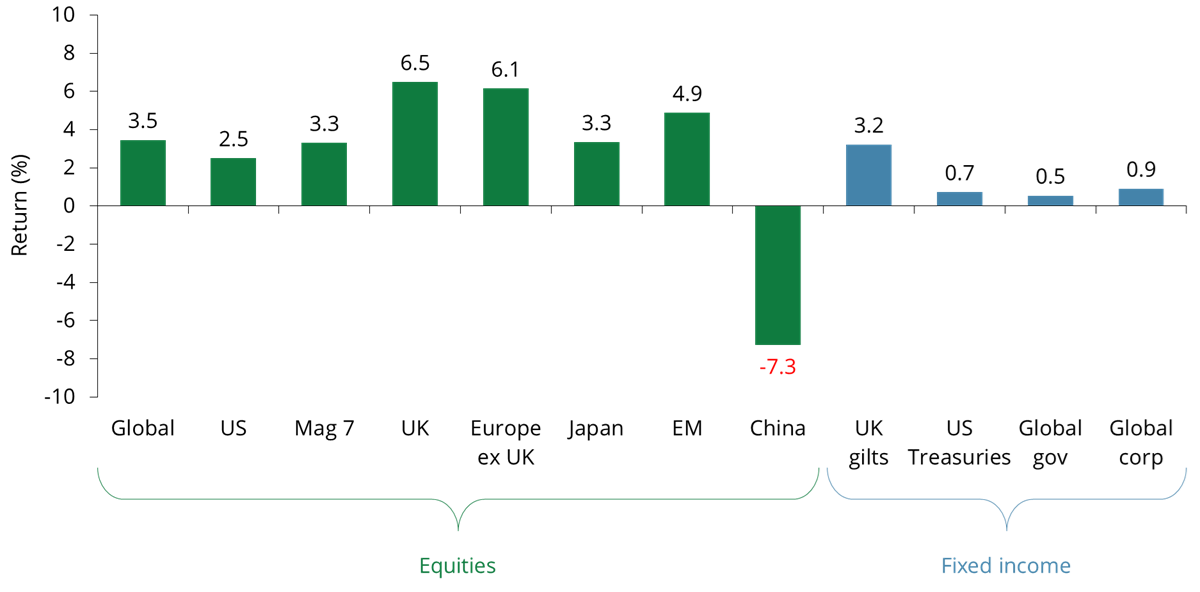

Global equity markets were up 3.5% in the final quarter of 2025, with many global equity indices finishing the year at record highs. Markets were helped by easing inflation, resilient company earnings, and growing expectations of future interest rate cuts from the major central banks. The fourth quarter continued the theme of European, UK, Japanese, and emerging market outperformance of the US thanks in part to the weaker dollar and relatively more attractive valuations. Although technology remained influential, the market showed early signs of broadening, with value stocks gaining momentum. Overall, investment sentiment remained positive despite some year-end profit taking.