1. Ensure we meet the standards required for our customers.

This objective requires good stewardship to be fully integrated into our investment process. This includes detailed due diligence and research of a fund’s responsible investment practices, in line with our responsible investment tier framework.

We work actively in collaboration with our manager research and operational due diligence teams to identify where engagement is required and communicate with managers as required.

2. Promote a well-functioning investment market over the long term.

This objective requires a stewardship approach that focuses on broader risks and opportunities.

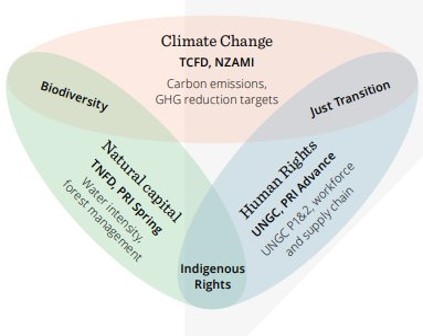

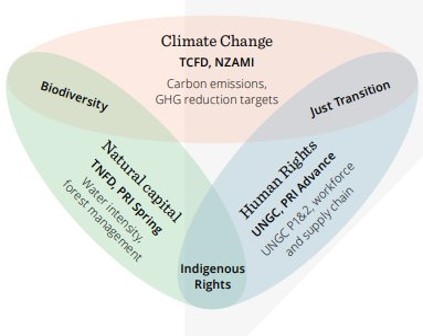

We monitor the regulatory landscape and research the most material themes emerging to inform and develop our thematic priorities (climate change, human rights, and natural capital).

These typically take the form of:

- Thematic and regulatory integration

- Collaborative engagements

- Endorsements and participation