We have designed the Quilter Smoothed Funds with simplicity and transparency in mind, to help you and your clients easily understand how their pension savings are managed.

A more straightforward approach

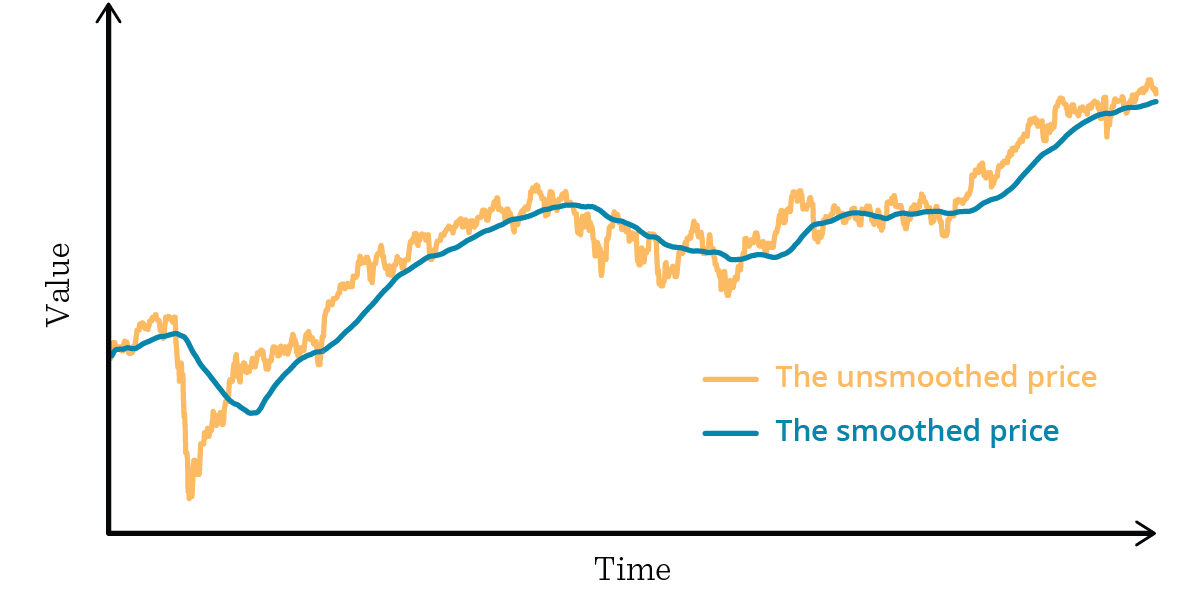

The Quilter Smoothed Funds use a method that is straightforward and easily explained using actual market returns, avoiding complex actuarial calculations. The investment value is calculated daily, using a rolling-average smoothing process. This enables the size of the day-to-day fluctuations to your clients’ fund value to be reduced.

The chart below shows how the smoothed price (shown in blue) tracks the unsmoothed price (shown in yellow) over the long term. The smoothing process means that the value of your clients’ investments fluctuate far less than a typical investment fund.

For illustrative purposes only.

While the Quilter Smoothed Funds aim to reduce the size of the day-to-day fluctuations to the fund value, they do not provide any guarantees. The smoothing process could reduce returns in rising markets and reduce losses in falling markets.

The value of your clients' investments can fall as well as rise. Your clients may get back less than they invested.