The Cirilium Portfolios offer you and your clients a risk-targeted, diversified multi-asset investment solution to help achieve their financial goals.

Giving you a choice of portfolios

You and your clients get the choice of:

Three investment styles

Active

A globally diversified, actively managed, solution.

Blend

A globally diversified solution investing in a blend of active and passive strategies.

Passive

A globally diversified, cost-effective solution investing in passive strategies.

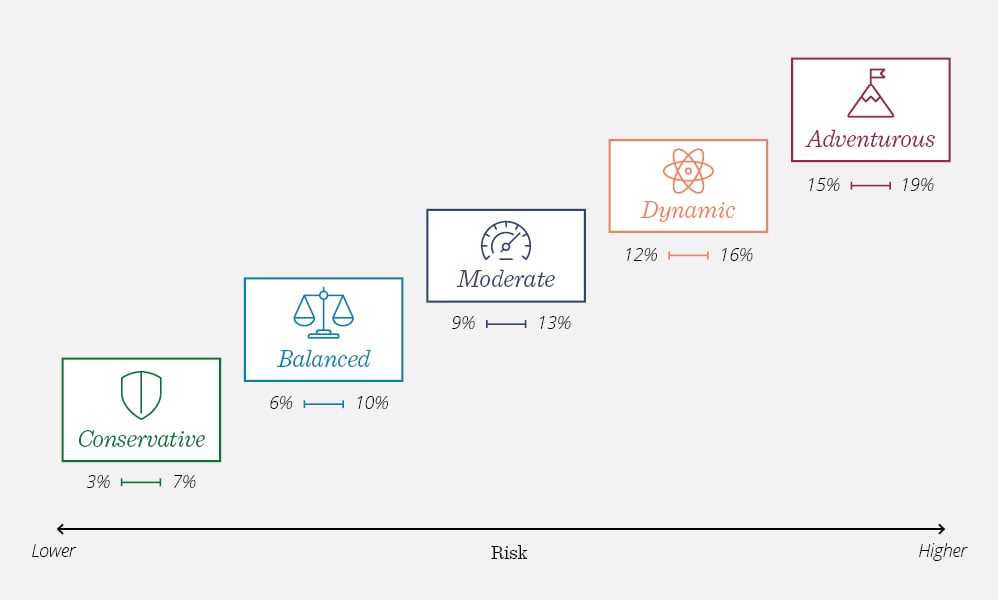

Five risk options

Conservative

The Conservative Portfolios are broadly diversified across asset classes, with exposure to equities of between 0-30% and with volatility of between 3 and 7%.

Balanced

The Balanced Portfolios are broadly diversified across asset classes, with exposure to equities of between 20-60% and with volatility of between 6 and 10%.

Moderate

The Moderate Portfolios are broadly diversified across asset classes, with exposure to equities of between 40-80% and with volatility of between 9 and 13%.

Dynamic

The Dynamic Portfolios are broadly diversified across asset classes, with exposure to equities of between 50-90% and with volatility of between 12 and 16%.

Adventurous

The Adventurous Portfolios are broadly diversified across asset classes, with exposure to equities of between 55-100% and with volatility of between 15 and 19%.

Step 1: Choosing a suitable investment style

We have three risk-targeted investment options - Cirilium, Cirilium Blend, and Cirilium Passive. The first decision is selecting one of these, allowing you to recommend options that meet the needs of your clients.

Three options, all built to deliver long-term value

All the portfolios share a common goal: to deliver long-term value for you and your clients.

The portfolios differ in two ways: their management style and what is in their ‘investment toolkit’. Together, these factors determine how we offer you and your clients great value.

| Cirilium Passive | Cirilium Blend | Cirilium | |

| Multi-asset approach | |||

| Strategic asset allocation | ✔ | ✔ | ✔ |

| Tactical asset allocation | ✔ | ✔ | |

| Investment toolkit | |||

| Passive fund and ETFs | ✔ | ✔ | ✔ |

| Active funds | ✔ | ✔ | |

| Investment trusts | ✔ | ||

| Great value | |||

| Fixed ongoing charge | 0.38% | 0.74% | 0.90-1.03% |

Step 2: Choosing an appropriate level of risk

Your second decision is selecting the risk level that best suits the appetite for risk of your client. We manage the portfolios to one of five risk levels by targeting specific volatility ranges.

By targeting specific ranges of volatility, you can be sure the portfolios are managed to the level of risk agreed with your clients.