This article explains how your estate will be distributed under the laws of England and Wales. It also touches briefly on how this differs from the laws of Scotland and Northern Ireland.

What are the rules of intestacy?

The rules of intestacy are the rules governing the distribution of a person’s assets where no will has been made and they are regarded as UK domiciled.

Wills

Unless an individual wishes for someone else to decide what happens to their assets when they die, it is important towrite a will. A will is an important legal document which allows the individual to detail how their assets (estate) are distributed following their death. It also names the persons they would like to be responsible for administering the distribution of their estate in accordance with the will, referred to as executors or legal personal representatives (LPRs).

It is important to write a new will to reflect any changes in circumstances or those of intended beneficiaries. Executors must act in accordance with the last valid will of an individual.

Intestacy

If an individual dies without leaving a valid will, the Court must decide who should administer their estate regardless of whether these would have been the people the deceased would have wanted to handle their estate.

An estate must be distributed in accordance with the rules of intestacy.

Summary for the main rules of intestacy for England and Wales

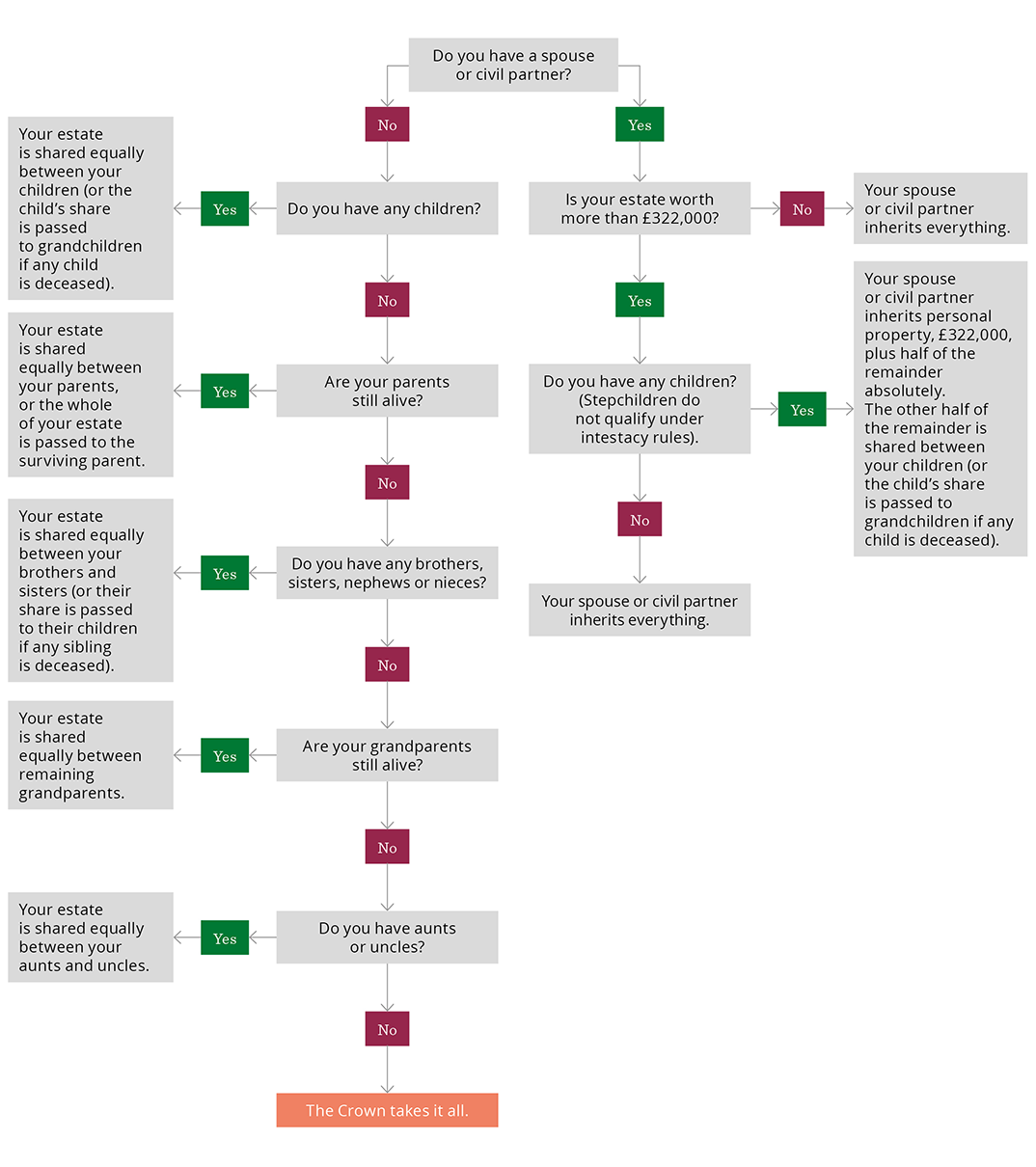

Follow this chart to see what would happen to your estate if you are considered UK domiciled and die without leaving a will in England and Wales on or after 1 October 2014.

If any beneficiary of this process is unmarried and under 18, their share of the inheritance is held in a trust known as a Statutory Trust until they are allowed to inherit.

Notes for the rules of intestacy

England and Wales

In England and Wales under the Law Reform (Succession) Act 1995, a wife, husband or civil partner* does not take a share on intestacy unless he or she survives the deceased for 28 days. If the wife, husband or civil partner does not survive this period, distribution will take place as if there was no surviving wife, husband or civil partner. This change applies to deaths on or after 1 January 1996.

- Personal property is, for example: car, furniture, pictures, clothing, jewellery. Children inherit on reaching age 18 or marrying below that age.

- Half-brothers and -sisters only inherit if there are no full brothers and sisters. Stepbrothers and stepsisters do not qualify under intestacy rules.

- An adopted child is treated as the legitimate child of the adopter(s). A child legitimated takes an interest as if born legitimate.

An illegitimate child takes any interest provided there is satisfactory proof of parentage. - All relatives are described as blood relationships; therefore the wife of an uncle, bearing the courtesy title aunt, does not qualify under intestacy rules.

- The property of a man or woman who is divorced does not go to the ex-spouse under the intestacy rules.

The property of a man or woman who completed dissolution of a registered civil partnership does not go to the ex-civil partner under intestacy rules.

Scotland

In Scotland, the Succession (Scotland) Act 1964 enforces some additional statutory and legal rights. Scottish Law requires a beneficiary to be alive at the date of the deceased's death to validly receive a claim.

When a person domiciled in Scotland dies intestate, the Scottish rules for the distribution of the estate of a deceased person take effect, subject to certain rights against the estate which are due to a surviving husband, wife or civil partner and the children of the deceased. These rights must be satisfied before the remainder of the estate can be distributed.

Where the term moveable estate is used this refers to any items that can be physically moved from one location to another. Net moveable estate means all moveable property after deduction for any debts of the deceased’s have been settled.

There are two types of rights to consider, ‘Statutory Prior Rights’ and ’Legal Rights’.

Statutory Prior Rights

The Statutory Prior Rights of a surviving husband, wife or civil partner* are:

- A right to a house in which the surviving husband, wife or civil partner* resided before death and which was owned by the deceased, where the value of the house does not exceed £473,000.

- In some circumstances, the husband, wife or civil partner* may choose to take the value of the house in money instead of the property itself. If the house is worth more than £473,000, then the spouse is entitled to £300,000 in money, ie not the house.

- The furniture of the house referred to above, up to the value of £29,000. The sum of £89,000 (£50,000 if the deceased is survived by children).

*as defined in the Civil Partnership Act 2004

Legal Rights

These are as follows:

- Jus relictae

The right of a widow (or civil partner) to one-half of her husband’s (or civil partner’s) moveable estate or to one-third if he or she leaves children entitled to ‘legitim’. - Jus relicti

The equivalent right of a widower in his deceased wife’s moveable estate. - Legitim

The right of children (including illegitimate and adopted children and the surviving children of deceased children who would have held a claim had they survived) to one-third of the net moveable estate if there is a surviving husband, wife or civil partner claiming legal rights, or to one-half if there is no surviving husband, wife or civil partner or if the surviving husband, wife or civil partner’s claim has been fulfilled.

The Statutory Prior Rights take precedence over Legal Rights and after both these rights have been satisfied, the estate of the person who died without making a will (intestate) in Scotland is distributed in a similar fashion to England and Wales.

Northern Ireland

In Northern Ireland the Northern Ireland Administration of Estates Act (Northern Ireland) 1955 governs the distribution of a deceased’s assets. The Succession (Northern Ireland) Order 1996 amended the 1955 Act to include a 28-day survivor succession clause in order to make a valid claim on an estate as in England and Wales.

In Northern Ireland if the deceased has no children and there are no surviving parents, brothers, sisters or nephews and nieces, then the surviving husband, wife or civil partner inherits the residual estate absolutely.

Thereafter the general principles of distribution of a deceased’s estate shown in the England and Wales chart above would be followed. However the Northern Ireland rules do differ slightly from those in England and Wales.