- Higher rate tax relief is achieved by extending tax bands via gross personal pension contributions.

- Relief at source gives 20% upfront; higher/additional rate relief must be claimed separately.

- Planning can eliminate higher rates of tax entirely in some cases.

Key takeaways

1. What is higher and additional rate tax relief?

This tax relief allows individuals to reduce the amount of income taxed at 40% or 45% by increasing the basic and higher rate bands. This is done by making gross personal pension contributions, which extend the thresholds used to calculate income tax.

2. How relief at source works

Most personal pensions, including Quilter’s, operate on a relief at source basis. This means:

- The investor pays a net contribution (e.g. £80).

- The scheme administrator grosses up the contribution to £100 by claiming 20% tax relief from HMRC.

This 20% is automatic and applies to all eligible contributions.

3. Claiming additional relief

Higher and additional rate taxpayers are entitled to extra relief* :

- Higher rate (40%): an extra 20% relief.

- Additional rate (45%): an extra 25% relief.

*The rates are different for different parts of the UK, however this article for simplicities sake is based on the England rates.

You can do this via your self-assessment. HMRC has walkthrough video to help with self-assessment here and the section on pension tax relief can be found around the 15 minute and 20 seconds mark.

Employer contributions are paid gross and do not attract personal tax relief, though they may be deductible for corporation tax.

Tax relief is calculated by extending the basic and higher rate tax bands, allowing more of the individual’s income to be taxed at lower rates.

4. Tax band extension explained

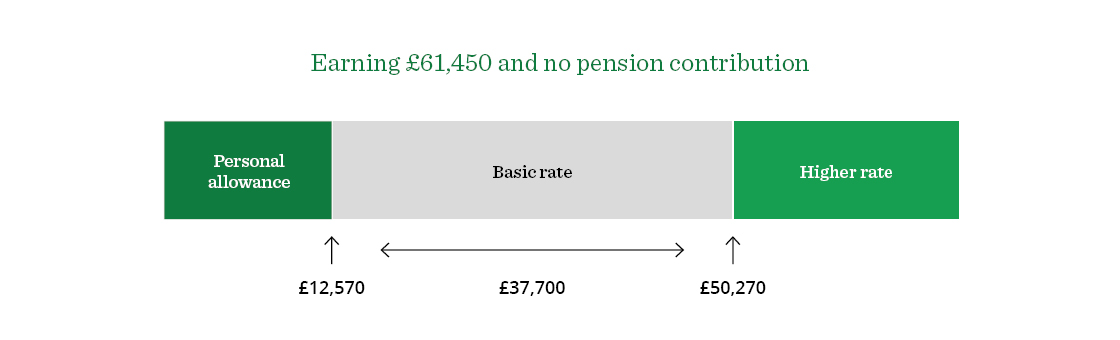

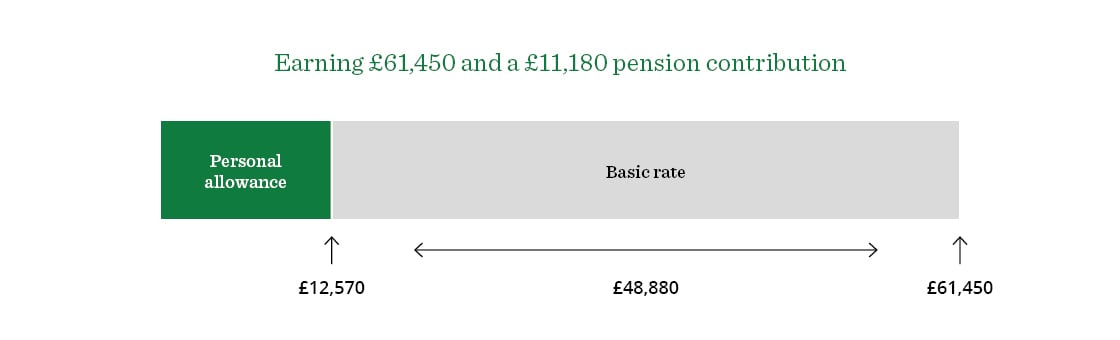

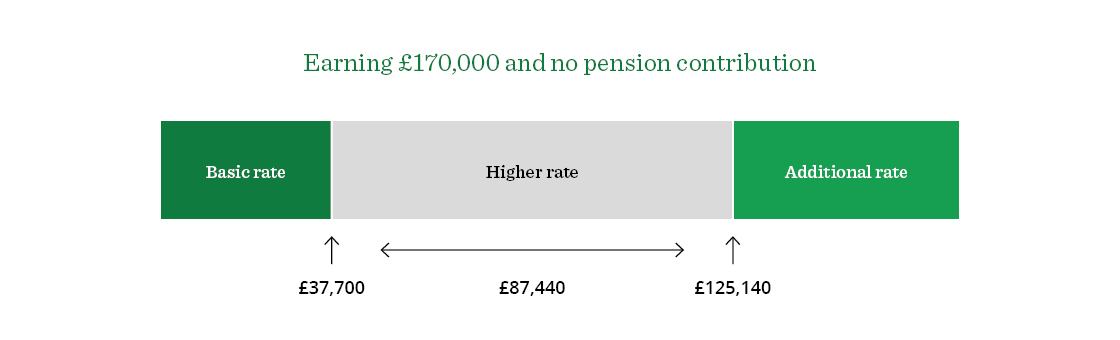

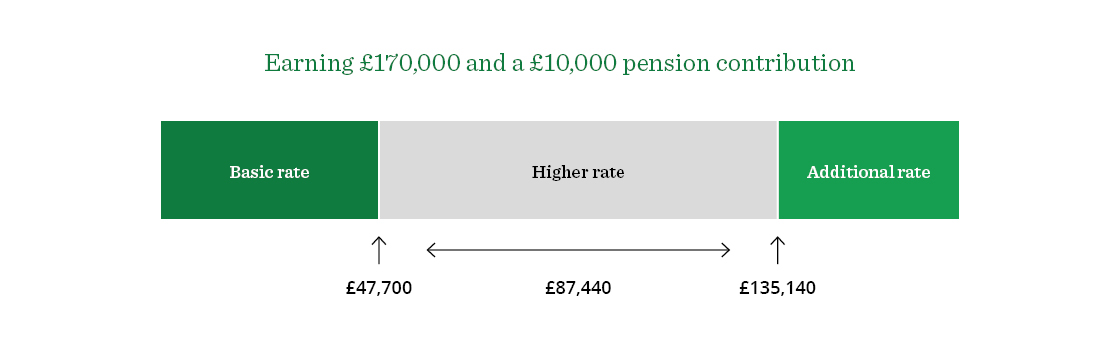

Gross personal contributions increase the thresholds for basic and higher rate tax bands. This means:

- More income is taxed at 20% instead of 40% or 45%.

- The individual receives the extra tax relief by not paying higher or additional rate tax on part of their income.

This mechanism is set out in Income Tax Act 2007 Part 2 Chapter 3 and FA 2004 Section 192(4).

Tax bands for England

These tax bands are displayed for the purpose of the examples below.

England Income Tax Bands (2025/26)

Band |

Income Range |

Tax Rate |

| Personal Allowance | Up to £12,750 | 0% |

| Basic Rate | £12,571 to £50,270 (£37,700) | 20% |

| Higher Rate | £50,271 to £125,140 (£74,870) | 40% |

| Additional Rate | Over £125,140 | 45% |

England Income Tax Bands (2025/26) - No Personal Allowance

Band |

Income Range |

Tax Rate |

| Basic Rate | £0 to £37,700 (£37,700) | 20% |

| Higher Rate | £37,701 to £125,140 (£87,440) | 40% |

| Additional Rate | Over £125,140 | 45% |

5. Examples

Below are two examples illustrating how the mechanism for extending the tax bands results in tax relief. Although not shown in the examples below, a contribution can also restore a person’s personal allowance.

6. Alternatives to the ‘relief at source’ method

An alternative way to receive tax relief on pension contributions is through the net pay arrangement. This method applies only when personal contributions are deducted directly from salary via payroll. Because the contribution is taken from gross pay before tax is calculated the member automatically receives full tax relief.

This arrangement cannot be used with personal pension schemes.

Occupational pension schemes such as auto enrolment and defined benefit schemes, , typically operate on a net pay arrangement basis.

Past performance is not a guide to future performance and may not be repeated.

Investment involves risk. The value of investments may go down as well as up and investors may not get back the amount originally invested.