Introducing the chargeable event gain income tax calculator

Introduction to a tool which calculates the income tax payable by individuals who realise a chargeable gain on their onshore bond.

Calculating the income tax liability on chargeable event gains is a hot topic on our technical helpdesk. This has only increased since the introduction of the personal savings allowance. To help advisers with these discussions we have a calculator to supplement our existing chargeable gain tool (which helps you calculate the chargeable event gain on a life assurance policy or redemption bond).

The calculator, Chargeable event gain – Income Tax calculator, calculates the income tax payable by individuals who have, or may in the future, realise a chargeable event gain(s). The calculator includes the following reliefs and exemptions within the calculation:

- Personal allowance

- Starting rate for savings income

- Personal savings allowance

- Top slicing relief

- Time apportionment relief

- Extension of basic rate band for personal pension contributions (relief at source)

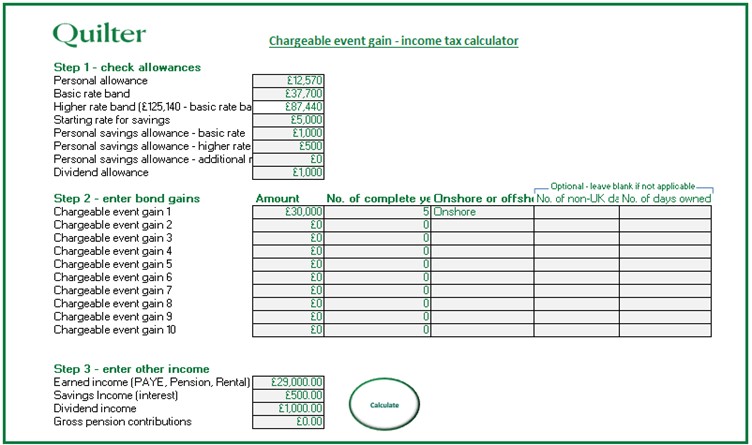

An example of the Chargeable event gain – Income Tax calculator input and output is provided below:

This test case shows a basic rate taxpayer with earned income of £29,000, savings income of £500 plus dividend income of £1,000. Within the 2023/24 tax year the individual has also made a £30,000 gain on an onshore investment bond over 5 complete years, providing them with total income of £60,500.

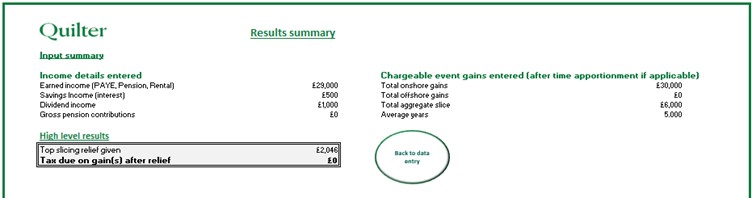

The output from the calculator shows no further tax liability on the bond gain following top slicing relief. This is calculated as follows:

- After the other income there is a basic rate band of £19,770 remaining (£12,570 personal allowance plus £37,700 basic rate band minus (£29,000 + £500 + £1,000))

- Once the bond gain is sliced over the 5 complete years, the slice of £6,000 sits comfortably within this

- This results in a basic rate liability on the bond gain only

- As an onshore bond gain has a basic rate credit associated with it (£6,000) this covers the basic rate liability in full (£30,000 * 20%).

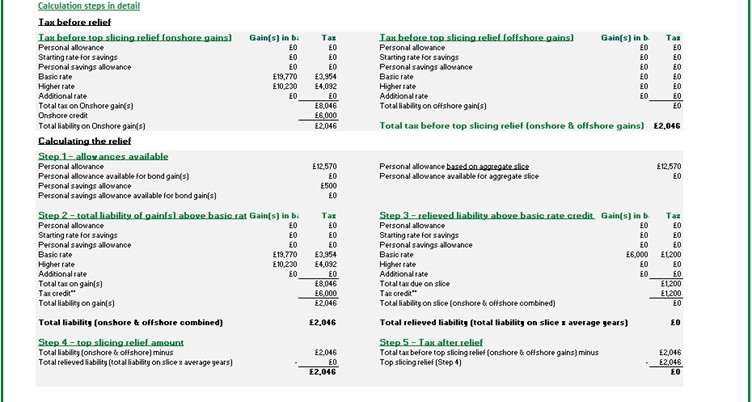

In the 'show calculation steps' in detail the following calculations can be seen:

Access the chargeable event gains - income tax calculator.

In order to provide an indicative tax liability on the chargeable gain(s) the calculator makes the following assumptions:

- Order of income is always earned income, savings income, dividends then gains from onshore life assurance plans.

- The calculator allocates allowances to other savings income prior to allocating to chargeable gains.

Both of these assumptions are contrary to an individual being able to make best use of allowances available to them.